NIFTY 50 is one of the most actively traded contracts in the world. NIFTY 50 consist of diversified 50 stock index accounting for 13 sectors of the economy.

Before we know more about it ,one should be aware of what is NSE ? National Stock Exchange (NSE) is an exchange (market) where traders, whether buyer or seller agrees to have an exchange of there respected securities .

The National Stock Exchange of India Ltd. (NSE) is the leading stock exchange in India and the third largest in the world by nos. of trades in equity shares in 2017, according to World Federation of Exchanges (WFE) report. In addition NSE was the first exchange in India to implement electronic or screen based trading.

It began operations in 1994 and is ranked as the largest stock exchange in India in terms of total and average daily turnover for equity shares every year since 1995, based on SEBI data.

Furthermore NSE has a fully-integrated business model comprising exchange listings, trading services, clearing and settlement services, indices, market data feeds, technology solutions and financial education offerings.

A stock exchange helps Stock brokers (A stockbroker is an individual /organization who are given a license By Sebi (The Securities and Exchange Board of India) to participate in the securities market on behalf of clients) to trade company stocks and other securities. In 1993 NSE (National Stock Exchange) was formed .

What is Nifty50

Nifty 50 is an equity benchmark index in India introduced by the NSE on April 21, 1996 . The term Nifty is derived from combining National & Fifty – as it consist of 50 actively traded stocks. it is used for a variety of purposes such as benchmarking fund portfolios, index based derivatives and index funds.

NIFTY 50 is owned and managed by NSE Indices Limited (formerly known as India Index Services & Products Limited (IISL)) . NSE Indices is India’s specialized company focused upon the index as a core product .

The NIFTY 50 is the flagship index on the National Stock Exchange of India Ltd. (NSE). The Index tracks the behavior of a portfolio of blue chip companies, the largest and most liquid Indian securities.

It includes 50 of the approximately 1600 companies listed on the NSE, captures approximately 65% of its float-adjusted market capitalization and is a true reflection of the Indian stock market.

Trading in derivative contracts based on NIFTY 50 The National Stock Exchange of India Limited (NSE) commenced trading in derivatives with index futures on June 12, 2000. The futures contracts on the NSE are based on the NIFTY 50.

The exchange introduced trading on index options based on the NIFTY 50 on June 4, 2001. Additionally, exchange traded derivatives contracts linked to NIFTY 50 are traded at Singapore Exchange Ltd. (SGX) and Taiwan Futures Exchange (TAIFEX).

Top Listed Companies

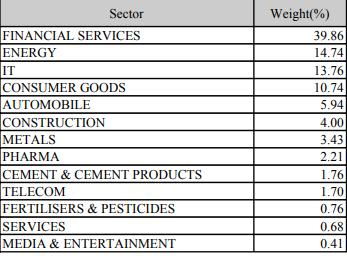

Sector Representation under Nifty50 : Below Image shows you the list of various sectors involved in building of Index Nifty 50 .

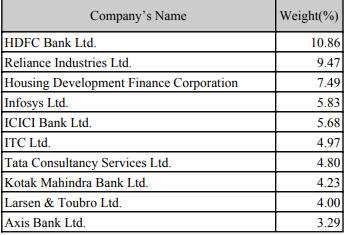

Top companies in Nifty50 Index By weightage

These are the companies listed which have heavy weightage in Nifty 50 Index.

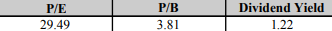

Fundamentals of Nifty50 Index:

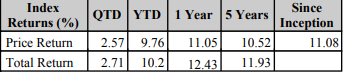

How Nifty 50 Index have Given return since Inception

Info Source NSE.

In chart and table above,since inception it has provided about 11.08 % of return . QTD,YTD and 1 year returns are absolute returns. Returns for greater than one year are CAGR returns.

Invest in Nifty50 Index

The best thing about investing in Index can reduce non-systematic risk :

In other words this type of risk include dramatic events such as a strike, plunging revenues, Higher financing cost, Declining profit margins, a natural disaster such as a fire, or something as simple as Management misconduct or slumping sales.

Two common sources of unsystematic risk are business risk and financial risk. However non-systematic risk can be diversified.

First thing to remember, instead of investing all your money in one company, you can choose to diversify and invest in 3-4 different companies (ideally from different sectors). When you do so, unsystematic risk is drastically reduced.

The NIFTY50 Index which constitutes of 50 major companies, can easily help in diversifying your portfolio .These are premium companies with high market capitalization.

For this reason just Invest in index and stay secure as we have already seen the returns annually given since inception The NIFTY 50 total return index delivered returns of 15.98% per annum during the previous 10 year period (as on March 29, 2019).

As a matter of fact India’s premier index, the NIFTY 50 over years has successfully become the ‘stock of the nation’ helping investors gauge the pulse of Indian capital market.

It has lived up to its core purpose of providing a fair representation of the Indian equity market. Nifty50 focuses on portfolio diversification, liquidity and replicability.

We hope you now have better understanding about Index and NSE as exchange. If you have any questions feel free to comment. Now you can trade Nifty futures and options at just Rs.5000 only at Rupeezy .