Introduction

When a company registers itself for the first time to sell its shares and raise funds, it enters the primary market also known as Initial Public Offering (IPO) .

This is also called getting listed in a stock exchange. Once it gets listed in public domain on any exchange (NSE, BSE) people can trade .

An IPO is a process by means of which a company can raise fund for its future expansion. The general public will subscribe to the shares by paying a certain price.

For this purpose Company need to go through several procedures.

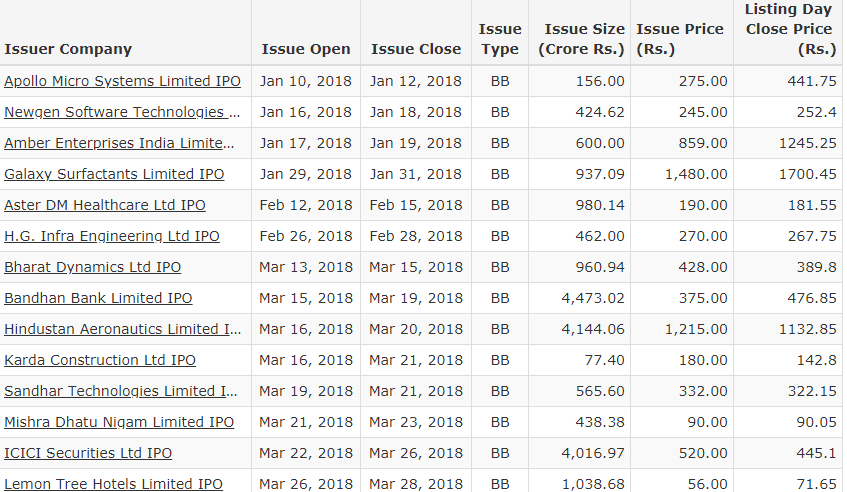

In the year 2018 itself number of IPO’s came including Main stream and SME is around 164. Below are few mainstream IPO’s launched last year:

We will try to understand each and every term mentioned above, However let us first understand, why there is need of IPO (Initial Public Offering) for a company.

Why does a Company Launch IPO (Initial Public Offering)?

A delivery company in Bhopal, Madhya Pradesh, is want to get in to logistics business. For this they need money, it can be borrowed from banks.

But what if they have borrowed much already? Will the banks still provide them loans? The prospects of this company looks good, especially in the booming e-commerce industry.

The reason for any company to go public is to raise funds in order to expand there business & infrastructure or to repay any loans.

For a company launching an IPO is inspiring time, as before this company is privately owned. This would be the first time owners of the company give up part of their ownership to stock holders in public.

It is one of the prestigious day for any company as they are getting listed on stock exchanges.

When a company goes public besides raising funds it is their hard work ,dedication, credibility are also at stake.

IPO((Initial Public Offering) also allows the company to attract top creamy talent because it can offer stock options to them known as ESOP.

What Is ESOP?

An ESOP (Employee stock ownership plan) refers to an employee benefit plan which offers employees an ownership interest in the organization.

Employees working for the company would have shares allotted to them as an incentive.

When a company goes public & start trading in exchange it also gives chance to angel investors, venture capitalist, promoters of the company to sell their share and exit position.

This will give them money they had invested earlier while forming the company.

Promoters and investors could become rich when they decide to sell off their stake as the IPO launched may shoot up high in exchange.

However this is not always the case.

For mergers and acquisition to another business or company stock shares helps. As shares can be used as form of payment to acquire them.

What Are The Steps Involved in Launching IPO?

Now we know why does a Company Goes Public, let us know how it happens in the background.

This are just good to know information although it is of no use until you own a company & in future you want to list it in market. Steps needed are listed below :

- Appointment of a Investment banker or merchant banker.

- Apply to SEBI with a registration statement which consist of details about company finance , why it wants to go public & what it exactly do.

- Getting a yes signal from SEBI after receiving registration details.

- DRHP (Draft Red Herring Prospectus) After getting a yes from SEBI company needs to prepare DRHP .This includes details about its promoters, reason for raising money, how the money will be used, risks involved with investing in the company etc.

- Advertising the IPO through Print ,electronic media ,raising awareness about IPO.

- Select the price band of newly launched IPO for public, for e.g Rs. 100 to 108

- Book Building involves process of collecting bids from investors at various prices mentioned while fixing price band . This opens for few days to let the investor subscribe the IP .

- Closure day is when the price of issued share is confirmed , price at which maximum bids are collected.

- Listing Day is when the stock gets listed on stock exchange. Depending on subscription of IPO whether over or under subscribe price of share shows up or down on exchange. Normal investor can start trading or investing in market.

Once the share get listed on exchange also known as Secondary market. This is the place where already listed companies trades/ sell stocks.

Investor or trader can buy or sell shares in secondary market. This the place where most of the trading happens.

Here any investor or trader can buy or sell his share at the current prevailing price of a share , depending up on his strategy.

How To Apply for IPO In India?

The first step is to choose the IPO that you wish to apply for. To get details about newly launched IPO’s you can visit our website rupeezy.

in under E-IPO check for IPO’s available. Once you have decided next step is to arrange funds.

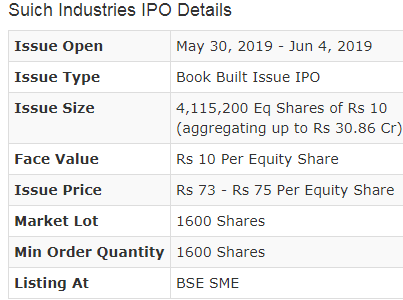

Below listed example of an IPO can give you a hint on how it looks like when it first appear in market:

As you can see This SME (Small and medium enterprises) IPO is about to get launched. You can see all the details listed.

One Important thing is LOT size this is the minimum no. of shares you need to buy in order to apply for this.

How To Apply In IPO From Your Trading Account?

A Demat Account is a prerequisite to apply for an IPO. This shares you bought will require a place to get stored, now this shares will get stored in your demat account.

So whenever you want to sell your shares, you can easily sell those from your trading account and it gets debited from your demat account.

A Demat account can be opened by submitting your PAN card, Aadhaar card, address and identity proofs. You can open hassle-free paperless demat and trading account with Asthatrade .

You can apply for an IPO through our website, Trading Account & bank account. We at Asthatrade provide you the seamless option to apply for any IPO.

The company usually sets a price band as we have discussed earlier.

The upper limit is known as the cap price while the lowest is called floor price. You have to bid for shares in this price range.

Once you have done Bidding ,possibility that you may get all shares or fewer shares. You might even fail to get any at all.

In these cases, the bank will unlock your bid money (in part or full). However if you are lucky enough you might get a full allotment.

After that you would get a Confirmatory Allotment Note (CAN) within six working days after closure of the IPO process, also known as book-built issue.

That’s it Once the shares are allotted, they will be credited to your demat account. After that you need to wait for the listing of shares on stock exchanges.

This is done within seven days from the finalization of issue.

Hope you have understood the basics of What is IPO (Initial Public Offering). Please leave your comments in case you have any concern.