In this blog, we will know the Highest Margin Brokers (Leverage Stock Brokers) in India at present. In India, it’s important to know the top stock brokers with high margins and low brokerage among the 3000+ brokers.

Professional traders and investors widely make use of margins to increase their returns from relatively small price changes in stocks.

We will be emphasizing three main segments of the share market. It will be NSE, Equity (Cash), Derivatives (Futures and Option)and Commodity (MCX).

You might have many questions related to margin or leverage in the stock market. We have tried to touch every aspect like:

The greatest advantage to buying on margin is that it boosts your purchasing power. When working with a relatively small amount of money, you can use margin to boost your returns.

However, before knowing the best margin brokers, one should be aware of what exactly margin, leverage or exposure means.

What Is Margin, Leverage or Exposure In the Stock Market?

In the stock market, margin trading means individual traders or investors can buy more stocks with minimum money in hand. Margin trading also refers to intraday or day trading in India.

Many stock brokers provide this service including Asthatrade. Margin trading involves buying and selling securities same day.

Margin is the money collected by exchanges before allowing brokers to trade in stocks and derivatives.

A broker’s account requires the minimum margin, known as the initial margin, to take a position.

The exchange requires brokers to keep money and assigns them limits to trade in the market.

As an illustration suppose a share named XYZ is currently trading at Rs.100. You have Rs.1000 in your trading account, with this you can only buy 10 shares.

However with margin money, if you are trading with Astha straightaway it gives you leverage of up to 40 times.

It means with the same Rs.1000 you can now buy 400 shares. The example we took is for Equity intraday in the cash segment.

As a trader or investor, you need to speculate or guess the stock movement in a particular session. Margin trading is an easy way of making real quick money online from your home.

Taking leverage or exposure has become very significant in the current scenario. Almost every stock broker in India will try to give you some exposure.

Margin Trading: Few Important Rules You Need To Keep In Mind

You need to square off your position at the end of every trading session. If you have bought shares, you have to sell them. And if you have sold shares, you will have to buy them at the end of the session.

To maintain your position for the following day, you have two options. You can either convert it into a delivery order or pay the full margin (FNO) once trading is complete.

If you don’t close your position in the market, your stock broker can do it for you.

Currently, we know what margin is. Now, we will look at the top margin brokers in India across all areas. So Let’s Start knowing them step by step.

However, If the trader’s view is wrong, then things might get risky while trading with high leverage.

That is why placing Stop loss is one of the major things every trader and investor should adhere to.

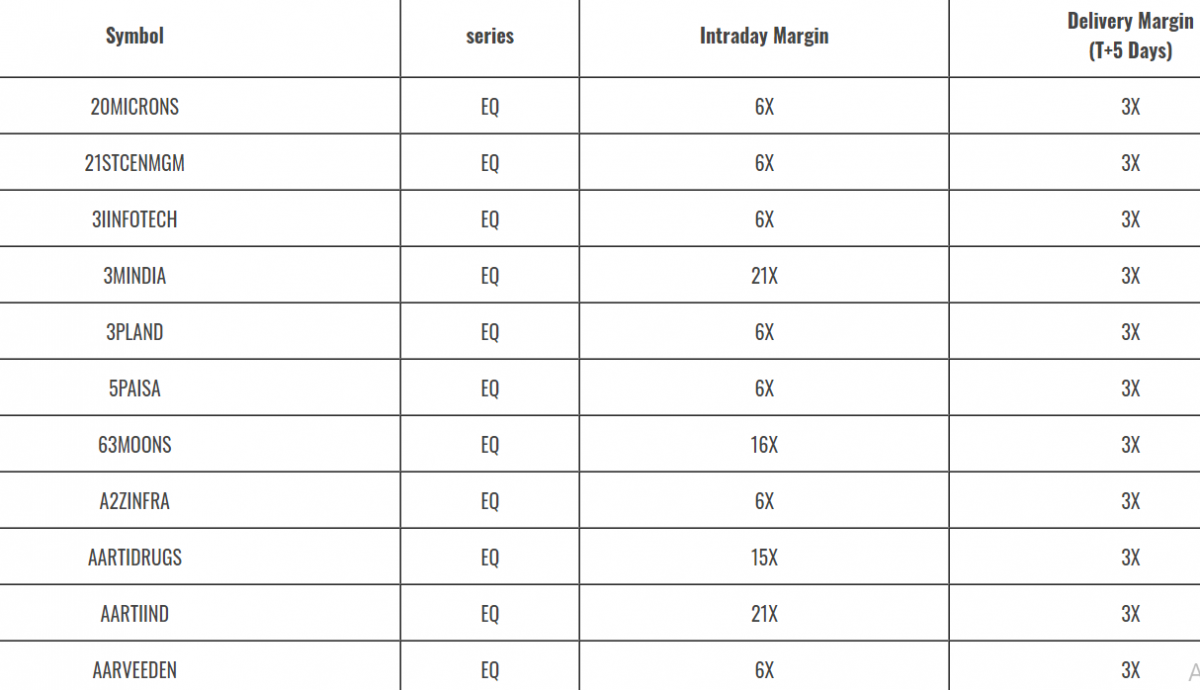

Highest Margin Brokers In Intraday Equity(MIS)

Asthatrade competes strongly by offering the highest leverage of 40x in India, without the need for bracket orders or Cover orders.

Some competitors offer exposure of 10 to 30 times using Cover and Bracket orders in the market. Below is the comparison table of the Highest Margin for intraday trading given by top stock brokers of India:

| Broker | Margin | |

|---|---|---|

| Asthatrade | Up to 40 times (Without BO and CO) | |

| UPSTOX/RKSV | Up to 20X times | |

| Zerodha | Up to 20X times | |

| SAS online | Up to 20X times | |

| 5Paisa | Up to 15X times | |

| Bonanza Online | Up to 10X times | |

| Tradejini | Up to 20X times. | |

| Aditya Birla Money | Up to 15X times. | |

| Nirmal Bang | Up to 10X times. | |

| Trade Smart online | Up to 20X times. |

Highest Leverage Brokers In Equity Delivery

So if you have this question in mind Which broker is best for delivery trading? The name of Asthatrade will surely find its place.

Yes, you heard it right, there are few brokers available who do provide margin in delivery trading. We at Asthatrade provide 8X(times leverage) the highest margin for delivery trading as well.

You can hold the share with a margin for up to T+5 days.

| Broker | Margin | |

|---|---|---|

| Asthatrade | Up to 3X times | |

| UPSTOX/RKSV | Up to 1X times | |

| Zerodha | Up to 1X times | |

| SAS online | Up to 1X times | |

| 5Paisa | Up to 3X times | |

| Bonanza Online | Up to 1X times | |

| Tradejini | Up to 1X times | |

| Aditya Birla Money | Up to 1X times. | |

| Nirmal Bang | Up to 1X times. | |

| Trade Smart online | Up to 1X times |

Highest Margin Brokers In Futures Trading

Whether you are buying a Futures contract in Equity or Index, an Extra margin can potentially increase the rate of return.

Therefore we at Asthatrade give our clients the highest margin in futures trading to trade freely.

So much so that to trade 1 lot of NIFTY Futures, the required amount is Rs. 4000 (MIS) i.e. you need to put only Rs.4000 in your Astha trading account and start trading.

Similarly, for BankNifty we do this in Rs. 4000 (MIS). If you want to trade stock futures we offer the highest leverage which is up to 66X times.

Check the margin availability for FNO.

| Broker | Margin | |

|---|---|---|

| Asthatrade | Up to 66X times | |

| UPSTOX/RKSV | Up to 4X times | |

| Zerodha | Up to 2.5X times | |

| SAS online | Up to 20X times | |

| 5Paisa | Up to 2X times | |

| Bonanza Online | Up to 3X times | |

| Tradejini | Up to 2.5X times. | |

| Aditya Birla Money | Up to 3 X times. | |

| Nirmal Bang | Up to 4 X times. | |

| Trade Smart online | Up to 5X times. |

Highest Margin Brokers In Options Trading

In derivatives, about 80% of trading happens in options. Asthatrade brokers provide you with the Highest margin in India for option writing(Selling) as well as buying.

As we all know the most traded options in India are NIFTY & BankNifty due to their liquidity.

The money required to trade 1 lot of NIFTY is just Rs.4000 (MIS). On the other hand, for 1 lot of BankNifty, it’s just Rs.4000 (MIS).

Similarly, for option writing and buying of stocks, we provide additional leverage. Check the margin availability for FNO.

In the case of Buying options, the premium required is 1.5 times of total premium.

You have to deposit as a margin the amount that results from dividing the total premium by 1.5.

| Broker | Margin | |

|---|---|---|

| Asthatrade | Buying 2X times and selling options Up to 66x times | |

| UPSTOX/RKSV | Up to 4x times | |

| Zerodha | Up to 2.5x times | |

| SAS online | Up to 20x times | |

| 5Paisa | Up to 2x times | |

| Bonanza Online | Up to 2x times | |

| Tradejini | Up to 2.5x times | |

| Aditya Birla Money | Up to 2x times | |

| Nirmal Bang | Up to 4x times | |

| Trade Smart online | Up to 5x times |

Highest Margin Brokers In Commodity Trading

Whether you want to trade Crude Oil or Gold, Silver or Zinc at Asthatrade you will find the best leverage in commodity(MCX) as well.

For example: Let us take an example of crude oil for instance currently trading at Rs.3900 lot size is 100 ( 3900*100 = 3,90,000) now trade this at only Rs. 2000 (MIS) only at Rupeezy.

Please note that the price of crude oil during this period (the coronavirus pandemic) varies depending on its high volatility.

In like manner let’s take an example of Gold currently trading @ 37000 lot size 100. You can trade GOLD with just Rs. 10,000 (MIS). You can check the margin for all commodities here.

| Broker | Margin | |

|---|---|---|

| Asthatrade | Up to 20X times | |

| UPSTOX/RKSV | Up to 3X times | |

| Zerodha | Up to 2.5X times | |

| SAS online | Up to 5X times | |

| 5Paisa | NA | |

| Bonanza Online | Up to 3X times | |

| Tradejini | Up to 3X times. | |

| Aditya Birla Money | Up to 2X times. | |

| Nirmal Bang | Up to 3X times. | |

| Trade Smart online | Up to 5X times. |

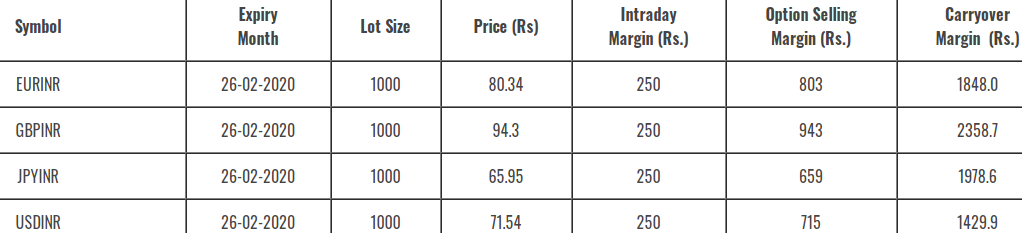

Highest Margin Broker For Currency Trading (Forex Trading)

At Asthatrade get a free currency trading account along with opening of equity & FNO. Now you can trade in currency with as low as Rs.250(MIS). Chek out the below image for margin in currency.

Disclaimer

Margin Policy can change any point of time based on risk and market volatility.

Click Here to check Rupeezy Margin Calculator for Equity(Cash), Future ,options and Commodities(mcx).

The process of account opening is very smooth & simple. You just need to log on to our website Asthatrade.com.

- Click on Open an account

- Enter your email address and phone number

- Confirm OTP

- Select a Segment like Equity & FNO or Commodity or select both.

- Make Payment through Net banking or Debit/credit card details etc.

- Upload Your Documents Like Income proof, In-person verification Known as IPV, and Signature.

- That’s it our sales team will reach you in case you need any help further.

Conclusion

The biggest risk you have when buying on margin is that it’s a double-edged sword. If you don’t know, how to handle the sword, fighting in the market will leave you nowhere.

Here comes the role of knowledge and learning. The more you are ready to learn about the market and its way of working, the more you will gain confidence.

Margin trading is a form of trading where you trade with leverage. To put it simply, leverage is what helps you control a bigger trade size with less money.

Hence it becomes of utmost importance for you to handle it with a lot of care, which means adopting new strategies to trade in the market.

If you have any feedback, or questions please leave it below in the comment box.

really helpful bolg for me I am an intraday tyrader and really happy to know advantages to trade in astha

Thanks for the blog. I have one question on leverage in selling options. In your post you mentioned Buying 1.5 times and selling options Up to 66x times. Are you mentioned the leverage of 66x times for stock options?? Please reply. I am planning to open account in astha

Its wow offer from Astha credit, also very lucrative and beneficier for intra-day traders like me, to grab the opportunity and to make huge money in a very few sum of amount.

super offer very very beneficial with minimum margin reqq. making huge money…..

Astha give highest margin with cash, f&o and mcx also. It is good for retail traders. Back office and support is also good.

Yes Rajesh the margin for stock option selling is upto 66xtimes, to open an paperless account online hassle-free please click on these and do registration process

Thanks arun for your positive comment

Thanks for your encouraging words Asish

Good to know Vinod

Thanks for sharing the post. The way you narrated the post is very good and understanding. After reading this post i cleared some of doubts. Please let me know for the upcoming posts.

Thanks for sharing the post. The way you narrated the post is good and understanding. After reading this post i learned some new things. Please let me know for the upcoming posts.

Hello Aastha,

What is margin required for carry over in option selling(index and stock option selling)

Thanks

Please restart Rs 20/- per trade facility for at least existing customers so that the customers can get the benefit of both – margin and discount brokerage.

This thing will also flourish the company.

Back office is fantastic, trading platform is also ok. Mobile app has also improved a lot.

For carry over margin calculator please check this link

Thanks a ton deepak for your feedback.

Sure we will try to make it possible , would require you to give us some time to make this happen.

Thanks Ankur for your kind words, you can subscribe to our blog to get the latest articles on your email.

How much charges for using margin money

If you are talking about using margin for delivery, than you can hold it for maximum period of T+5 days with interest of 15% per Annum. Other than that you can use margin in intraday trading FNO,COMMODITY & Currency without any cost.(excluding brokerage)

I LIKE VERY MUCH THE ASTHA TRADE. I AM DOING THE TRADE IN OPTION REGULARLY. IF YOU START Rs 20/PER ORDER PLAN WITH SAME EXPOSURE VERY USEFUL TO WIN MORE. THANK YOU

Thanks for your comment Ravidran, we are forwarding your feedback to the concerned managment team.

What if I want to carry forward my position for more than 5 days. ??

thanks for sharing best information .

Its amazing Article !! thanks for sharing valuable information.

What about withdrwal of funds how much time you take even after T+2

Sir, please provide or add feature like Trade on Charts like Trailing SL drag & drop on the charts

Hi, I am planning to open an account for intraday trading in NSE and BSE. What is the account opening amount required and how much is the margin provided. I have traded in 5paisa Zerodha earlier and am very much doing so through Astha now as the reviews are positive.

Thank you for reading the blog, check open a free demat account. For other Pricing charges,

Hi, thank you for visiting the blog. All the features that are available in mobile application are also available in TradingView Terminal. Trailing SL feature is not available as of now, you can drag and drop SL on charts.

Hi, please use MTF (Margin Trading Facility)

consequatur et et est voluptas molestias nihil aperiam voluptatem consectetur optio autem omnis. qui minima aut a exercitationem eos blanditiis inventore nesciunt cupiditate pariatur est quisquam tota

I for all time emailed this website post page to all my associates, as if like to read it next my contacts will too.

You actually make it appear so easy along with your presentation however I to find this matter to be really one thing that I feel I would never understand. It sort of feels too complex and very wide for me. I’m taking a look ahead to your next submit, I will attempt to get the hold of it!

Because the admin of this web page is working, no hesitation very rapidly it will be famous, due to its quality contents.

I simply couldn’t depart your web site before suggesting that I actually loved the standard information an individual supply on your visitors? Is gonna be back steadily to check up on new posts

What’s up mates, its enormous piece of writing regarding educationand entirely explained, keep it up all the time.

I read this article fully on the topic of the comparison of latest and preceding technologies, it’s awesome article.

I am regular reader, how are you everybody? This article posted at this web site is actually pleasant.

wonderful issues altogether, you simply gained a new reader. What would you recommend about your post that you just made some days ago? Any certain?

I’m not sure exactly why but this weblog is loading extremely slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later and see if the problem still exists.

I visited many websites but the audio feature for audio songs existing at this site is really excellent.

Interesting blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple adjustements would really make my blog jump out. Please let me know where you got your design. Appreciate it

Hello, Neat post. There is a problem together with your website in internet explorer, may test this? IE nonetheless is the marketplace chief and a big portion of folks will miss your fantastic writing because of this problem.

Hey! Someone in my Myspace group shared this site with us so I came to take a look. I’m definitely loving the information. I’m bookmarking and will be tweeting this to my followers! Wonderful blog and outstanding design.

Hurrah! At last I got a blog from where I be capable of in fact obtain helpful facts concerning my study and knowledge.

you are truly a just right webmaster. The website loading velocity is incredible. It seems that you’re doing any distinctive trick. Also, The contents are masterpiece. you have performed a excellent job on this subject!

At this time I am ready to do my breakfast, after having my breakfast coming again to read other news.

Hello, i read your blog from time to time and i own a similar one and i was just wondering if you get a lot of spam remarks? If so how do you stop it, any plugin or anything you can suggest? I get so much lately it’s driving me insane so any assistance is very much appreciated.

Hello Dear, are you genuinely visiting this web page on a regular basis, if so afterward you will definitely obtain nice knowledge.

Thanks , I’ve just been searching for info approximately this topic for a long time and yours is the greatest I’ve found out so far. But, what about the conclusion? Are you sure about the supply?

Attractive component of content. I simply stumbled upon your site and in accession capital to claim that I get in fact enjoyed account your blog posts. Anyway I will be subscribing on your feeds and even I fulfillment you access constantly quickly.

Hi Dear, are you really visiting this web page on a regular basis, if so afterward you will definitely get fastidious know-how.

Hi i am kavin, its my first time to commenting anywhere, when i read this piece of writing i thought i could also make comment due to this brilliant article.

Wonderful work! That is the type of info that are supposed to be shared across the net. Shame on Google for no longer positioning this submit upper! Come on over and consult with my site . Thank you =)

Hi there, just became aware of your blog through Google, and found that it’s truly informative. I am gonna watch out for brussels. I’ll appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Its not my first time to visit this website, i am browsing this website dailly and obtain good facts from here all the time.

Having read this I believed it was rather enlightening. I appreciate you spending some time and energy to put this article together. I once again find myself personally spending a significant amount of time both reading and posting comments. But so what, it was still worthwhile!

Hello, its nice piece of writing on the topic of media print, we all be familiar with media is a fantastic source of facts.

Hiya! I know this is kinda off topic nevertheless I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog post or vice-versa? My blog goes over a lot of the same subjects as yours and I feel we could greatly benefit from each other. If you might be interested feel free to shoot me an email. I look forward to hearing from you! Wonderful blog by the way!

I visited several web sites but the audio feature for audio songs present at this website is in fact excellent.

Hey! I know this is sort of off-topic but I had to ask. Does operating a well-established website such as yours require a massive amount work? I am brand new to writing a blog however I do write in my diary daily. I’d like to start a blog so I will be able to share my personal experience and thoughts online. Please let me know if you have any kind of suggestions or tips for brand new aspiring bloggers. Thankyou!

I think this is one of the most significant info for me. And i’m glad reading your article. But should remark on few general things, The site style is perfect, the articles is really excellent : D. Good job, cheers

Very good post! We are linking to this particularly great post on our website. Keep up the great writing.

WOW just what I was searching for. Came here by searching for %meta_keyword%

What’s up, the whole thing is going perfectly here and ofcourse every one is sharing data, that’s in fact excellent, keep up writing.

For most recent news you have to visit world-wide-web and on web I found this website as a finest web site for latest updates.

Fastidious respond in return of this issue with firm arguments and describing the whole thing concerning that.

With havin so much written content do you ever run into any issues of plagorism or copyright violation? My website has a lot of exclusive content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the web without my permission. Do you know any solutions to help prevent content from being stolen? I’d certainly appreciate it.

I’m not sure why but this weblog is loading incredibly slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later and see if the problem still exists.

hello!,I really like your writing so a lot! percentage we keep up a correspondence extra approximately your post on AOL? I require an expert in this space to resolve my problem. May be that is you! Taking a look ahead to peer you.

Hi my family member! I want to say that this post is awesome, nice written and come with almost all vital infos. I would like to look more posts like this .

Hello there, I discovered your website by the use of Google while searching for a similar matter, your site came up, it seems to be good. I have bookmarked it in my google bookmarks.

Hi there, just turned into alert to your weblog thru Google, and located that it is really informative. I’m gonna be careful for brussels. I’ll appreciate for those who continue this in future. Numerous folks will be benefited out of your writing. Cheers!

Thanks on your marvelous posting! I definitely enjoyed reading it, you will be a great author.I will always bookmark your blog and definitely will come back later in life. I want to encourage you to continue your great work, have a nice evening!

Thanks designed for sharing such a fastidious thinking, paragraph is nice, thats why i have read it entirely

Hmm is anyone else experiencing problems with the images on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

Hi! I could have sworn I’ve been to this blog before but after looking at some of the posts I realized it’s new to me. Regardless, I’m definitely delighted I stumbled upon it and I’ll be book-marking it and checking back regularly!

After looking into a few of the articles on your website, I truly appreciate your way of writing a blog. I added it to my bookmark webpage list and will be checking back soon. Please check out my website as well and tell me how you feel.

Keep on working, great job!

Hello my family member! I wish to say that this post is amazing, nice written and come with almost all vital infos. I’d like to look more posts like this .

Hey just wanted to give you a brief heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different internet browsers and both show the same outcome.

I’m really enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a developer to create your theme? Fantastic work!

No matter if some one searches for his required thing, therefore he/she desires to be available that in detail, thus that thing is maintained over here.

Appreciating the time and effort you put into your blog and in depth information you provide. It’s great to come across a blog every once in a while that isn’t the same outdated rehashed material. Fantastic read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

I really like what you guys are up too. This type of clever work and exposure! Keep up the awesome works guys I’ve added you guys to my blogroll.

Heya i’m for the primary time here. I came across this board and I find It really helpful & it helped me out a lot. I hope to provide something back and help others such as you aided me.

It is not my first time to pay a visit this site, i am visiting this website dailly and get nice data from here all the time.

Hey! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My blog looks weird when viewing from my iphone 4. I’m trying to find a template or plugin that might be able to fix this problem. If you have any suggestions, please share. Many thanks!

I read this piece of writing completely about the difference of latest and previous technologies, it’s remarkable article.

Hi! I know this is sort of off-topic but I had to ask. Does running a well-established blog such as yours require a lot of work? I am completely new to blogging however I do write in my diary everyday. I’d like to start a blog so I can share my experience and views online. Please let me know if you have any kind of suggestions or tips for new aspiring blog owners. Appreciate it!

Excellent pieces. Keep posting such kind of information on your site. Im really impressed by your site.

Hello there, You have done a fantastic job. I’ll definitely digg it and for my part suggest to my friends. I am sure they will be benefited from this site.

I couldn’t refrain from commenting. Well written!

Hi there, I check your new stuff like every week. Your writing style is awesome, keep up the good work!

Hello there! I simply want to offer you a huge thumbs up for the excellent information you have here on this post. I am coming back to your blog for more soon.

Hmm it appears like your blog ate my first comment (it was extremely long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to everything. Do you have any points for rookie blog writers? I’d genuinely appreciate it.

You made some decent points there. I checked on the internet for more information about the issue and found most people will go along with your views on this site.

This page really has all the information and facts I needed concerning this subject and didn’t know who to ask.

Hurrah, that’s what I was looking for, what a data! existing here at this website, thanks admin of this site.

This is really interesting, You are a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your website in my social networks!

Today, I went to the beachfront with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

Hello there! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

When some one searches for his essential thing, thus he/she wants to be available that in detail, therefore that thing is maintained over here.

Admiring the time and effort you put into your site and in depth information you provide. It’s nice to come across a blog every once in a while that isn’t the same out of date rehashed information. Excellent read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

Hey there I am so glad I found your blog, I really found you by mistake, while I was browsing on Askjeeve for something else, Anyways I am here now and would just like to say thanks for a fantastic post and a all round exciting blog (I also love the theme/design), I don’t have time to go through it all at the minute but I have saved it and also added in your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the superb b.

Pretty section of content. I just stumbled upon your site and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Any way I will be subscribing to your feeds and even I achievement you access consistently fast.

Wow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say superb blog!

I am extremely inspired with your writing talents as smartly as with the structure in your blog. Is that this a paid subject matter or did you customize it your self? Anyway stay up the excellent quality writing, it’s uncommon to see a nice weblog like this one these days..

Pretty section of content. I just stumbled upon your website and in accession capital to assert that I get actually enjoyed account your blog posts. Anyway I will be subscribing to your feeds and even I achievement you access consistently fast.

Hi there, You have done an incredible job. I’ll certainly digg it and personally suggest to my friends. I am confident they’ll be benefited from this web site.

Valuable info. Fortunate me I found your web site by accident, and I am stunned why this twist of fate didn’t took place earlier! I bookmarked it.

Hi I am so excited I found your site, I really found you by error, while I was looking on Google for something else, Anyhow I am here now and would just like to say thank you for a remarkable post and a all round entertaining blog (I also love the theme/design), I don’t have time to read through it all at the moment but I have saved it and also added in your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the awesome job.

Hi there, just became alert to your blog through Google, and found that it is really informative. I am gonna watch out for brussels. I will appreciate if you continue this in future. Numerous people will be benefited from your writing. Cheers!

Wow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say great blog!

Hi, I do believe this is a great web site. I stumbledupon it 😉 I may revisit once again since I book marked it. Money and freedom is the greatest way to change, may you be rich and continue to help others.

If you are going for most excellent contents like myself, just go to see this website all the time since it gives quality contents, thanks

Wow, this piece of writing is pleasant, my younger sister is analyzing these things, therefore I am going to let know her.

What a stuff of un-ambiguity and preserveness of precious experience on the topic of unpredicted emotions.

I am curious to find out what blog system you happen to be utilizing? I’m experiencing some minor security issues with my latest site and I’d like to find something more secure. Do you have any solutions?

I have been surfing online more than three hours these days, yet I by no means found any attention-grabbing article like yours. It’s pretty value enough for me. Personally, if all webmasters and bloggers made just right content material as you probably did, the web will be much more useful than ever before.

Incredible story there. What occurred after? Thanks!

Hello, I enjoy reading through your post. I like to write a little comment to support you.

Hello! I know this is somewhat off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot!

You should be a part of a contest for one of the highest quality sites online. I most certainly will highly recommend this website!

We are a group of volunteers and opening a new scheme in our community. Your web site offered us with valuable information to work on. You have done an impressive job and our entire community will be thankful to you.

Great info. Lucky me I found your site by chance (stumbleupon). I’ve book-marked it for later!

Hi there friends, its impressive post concerning cultureand completely explained, keep it up all the time.

It’s going to be ending of mine day, except before finish I am reading this wonderful post to increase my knowledge.

Link exchange is nothing else however it is just placing the other person’s blog link on your page at appropriate place and other person will also do same in favor of you.

I seriously love your site.. Excellent colors & theme. Did you make this amazing site yourself? Please reply back as I’m trying to create my own personal website and want to learn where you got this from or what the theme is named. Appreciate it!

Truly when someone doesn’t understand afterward its up to other users that they will help, so here it takes place.

It is in point of fact a great and useful piece of info. I am happy that you just shared this useful information with us. Please stay us up to date like this. Thank you for sharing.

You ought to be a part of a contest for one of the finest blogs online. I am going to recommend this blog!

When some one searches for his essential thing, so he/she needs to be available that in detail, thus that thing is maintained over here.

Wow, wonderful blog structure! How lengthy have you ever been blogging for? you make blogging look easy. The full look of your web site is wonderful, as neatly as the content material!

Very good info. Lucky me I found your site by accident (stumbleupon). I have saved it for later!

If you wish for to grow your knowledge only keep visiting this site and be updated with the hottest information posted here.

fantastic submit, very informative. I’m wondering why the other specialists of this sector don’t understand this. You should proceed your writing. I’m sure, you have a huge readers’ base already!

Superb website you have here but I was wondering if you knew of any message boards that cover the same topics discussed here? I’d really like to be a part of community where I can get suggestions from other experienced individuals that share the same interest. If you have any recommendations, please let me know. Many thanks!

Very energetic blog, I enjoyed that bit. Will there be a part 2?

I go to see everyday some sites and sites to read posts, except this web site provides feature based writing.

My family members always say that I am wasting my time here at web, however I know I am getting experience all the time by reading such nice articles.

I don’t know whether it’s just me or if perhaps everybody else encountering issues with your site. It appears as though some of the written text in your posts are running off the screen. Can somebody else please comment and let me know if this is happening to them too? This may be a issue with my browser because I’ve had this happen previously. Kudos

It’s going to be ending of mine day, except before finish I am reading this fantastic paragraph to improve my knowledge.

This website was… how do I say it? Relevant!! Finally I have found something which helped me. Kudos!

Genuinely no matter if someone doesn’t be aware of afterward its up to other people that they will assist, so here it happens.

My family always say that I am killing my time here at web, however I know I am getting knowledge everyday by reading thes nice content.

This is my first time visit at here and i am in fact happy to read all at single place.

I am curious to find out what blog system you happen to be utilizing? I’m experiencing some small security problems with my latest website and I’d like to find something more safeguarded. Do you have any solutions?

My partner and I stumbled over here coming from a different website and thought I might check things out. I like what I see so now i’m following you. Look forward to finding out about your web page repeatedly.

Fastidious replies in return of this query with real arguments and explaining the whole thing on the topic of that.

Appreciate the recommendation. Will try it out.

you’re in reality a good webmaster. The web site loading pace is amazing. It sort of feels that you are doing any distinctive trick. In addition, The contents are masterwork. you’ve done a excellent job on this topic!

Nice answers in return of this matter with genuine arguments and telling the whole thing regarding that.

Hello! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in trading links or maybe guest authoring a blog post or vice-versa? My website covers a lot of the same topics as yours and I believe we could greatly benefit from each other. If you might be interested feel free to send me an e-mail. I look forward to hearing from you! Wonderful blog by the way!

It is actually a great and useful piece of information. I’m satisfied that you simply shared this useful info with us. Please keep us informed like this. Thanks for sharing.