Introduction

In other words, Just like in normal market the one who buys the product is consumer or buyer and the one who sells it seller, distributor ,retailer ,etc.

To put it differently basically ,there is an exchange (market) where traders, whether buyer or seller agrees to have an exchange of there respected securities .

A stock exchange helps Stock brokers (A stockbroker is an individual /organization who are given a license By SEBI.

(The Securities and Exchange Board of India) to participate in the securities market on behalf of clients) to trade company stocks and other securities.

In other words stockbroker has the same role as an agent of some service offering company or individual .

The Stockbroker acts as agent for buyers and sellers of securities, a commission is charged for this service.

A stock may be bought or sold only if it is listed on an exchange.

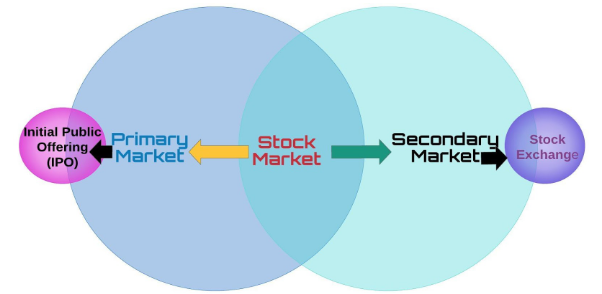

The key difference is that a stock market helps you trade financial instruments like bonds, mutual funds, derivatives as well as shares of companies.

Another key point share market only allows trading of shares .

We will try to use less jargon for now so that basic knowledge can be developed even to the beginners in the market .

In the meantime before we see how it works let’s check the history of Indian markets .

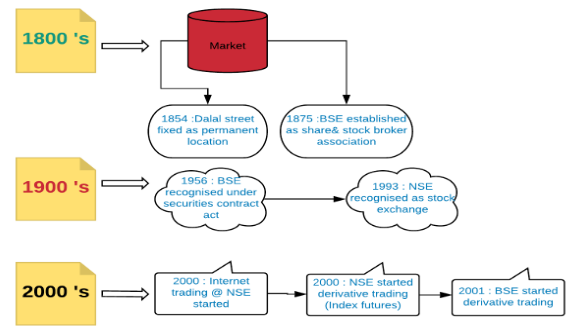

History of Share/stock Markets In India

But it’s very unfortunate to know that even today less than 18 million out of total population of more than 1 billion in India participate in market securities .

One of the reasons can be the lack of knowledge essentially needed for the market .

As a matter of fact once you start, you will realize that the investment is not that complicated as it seems .

With this in mind i would request you to start your journey towards greater future ahead.

- Why there is a need of stock exchanges or share markets ?

- Why does a company list its shares in the open market (IPO- initial public offering)?

- What exactly happens after the company goes public?

- Why there is even need for investment , why someone should invest or trade at all ?

- What are the Types of investment available in market ?

- Who is SEBI (security & exchange board of India)?

- Who is a broker & what does it do ?

- Does investment in market really helps securing future ?

- Can you earn in market every day (Intraday trades) ?

- What are the things to know before investing ? How do I actually make money from investing in stocks?

At the present time you might have lot of questions in your mind, do not get worried .

Now that you have started showing interest in learning about the market, one thing you have to keep in mind that it’s a process which takes time you .

“ Patience is the key to unlock the future” . Sooner or later you will get the core concepts of market.

Recap of what we have understood till now

- Stock exchange : platform that provides the facilities used to trade company stocks and other securities.

- A stock may be bought or sold only if it is listed on an exchange.

- Difference is that a stock market helps you trade financial instruments like bonds, mutual funds, derivatives as well as shares of companies. A share market only allows trading of shares .

- Two types of market : Primary & secondary .

- SEBI is the regulator for the securities market in India. It was established in 1988 .

- Stock broker is an individual /organization who are given a license By SEBI to participate in the securities market on behalf of its clients .

- For e.g Asthatrade is one of the leading brokers in india providing highest leverage .

- Indian market have two stock exchanges BSE (Bombay stock exchange ) & NSE (National stock exchange ) .

Conclusion

Above all nowadays, all trading happens in computer terminals at the broker’s office or on the internet. Share market and stock market is one and the same thing.

We at Rupeezy provides you with the highest margin in intraday trading for equity ,options ,futures & commodity segment .

Once you grasp basics of Share Market you can open all-in one trading & demat account with us and start your journey .

Asthatrade help in empowering every eager investor or traders to understand the working of the share market by providing information on stock market basics.

How to trade, types of financial instruments, and successful trading strategies.

Not to mention it’s you who have to learn . So keep learning and keep earning .

Thanks dear for a complete know how of stock market. I might say that a good post for a newbie trying to learn and earn from stock market.

Thanks Abhay