Introduction

As SEBI has proposed the new hedging margin framework in fno for all traders.

In this blog we will try to understand how this will effect you as well as how you can place multi leg order in Rupeezy wave and Odin diet.

This new hedging margin framework will help traders with position build for mutually hedged in future and options contracts.

This primarily will help margin reduction for positions that hedge each other. The changes are going to benefit traders in fno who hedge there position.

Just to make it clear there will be slight impact on naked FNO position depending on the volatility.

As the Price Scan Range (PSR) which is used to assess the FNO margin has been scaled up to 6σ (sigma) from earlier 3.5σ,

the margin required for naked positions will be higher and will be reduced as the volatility in the market reduces.

Hedging is a strategy to reduce the risk of adverse price fluctuations in an asset. A hedge can be made from many types of financial instruments,

including stocks, insurance, forward contracts, swaps, options, futures contracts. Hedging in a way helps you to protect your trading positions from making a loss.

So, if a client takes two mutually offsetting positions, this will allow them to reduce the total margin payment required to take the position in market.

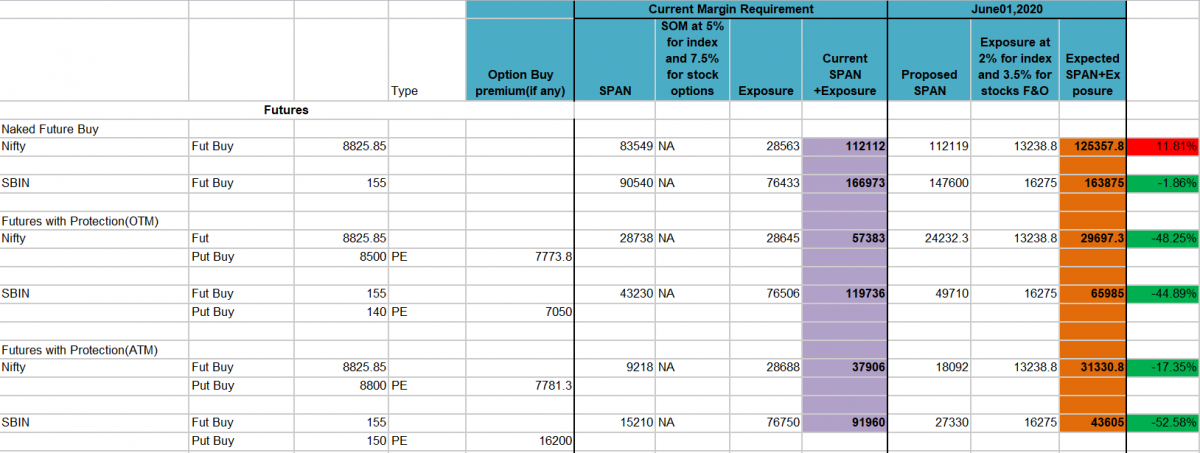

New Hedging Margin In Futures (Index & Stocks)

As you can see in the above image, the margin has increased a little for naked futures buy for nifty index this happened because, Price scan range(PSR) is now 6 Sigma compare to 3.5 Sigma,

This means is that if volatility picks up, margin increase will be little higher than before. However, if you are hedging the position in futures by taking two position simultaneously,

you can see the purple and orange tab for margin requirement now compared to previous, which has come down significantly.

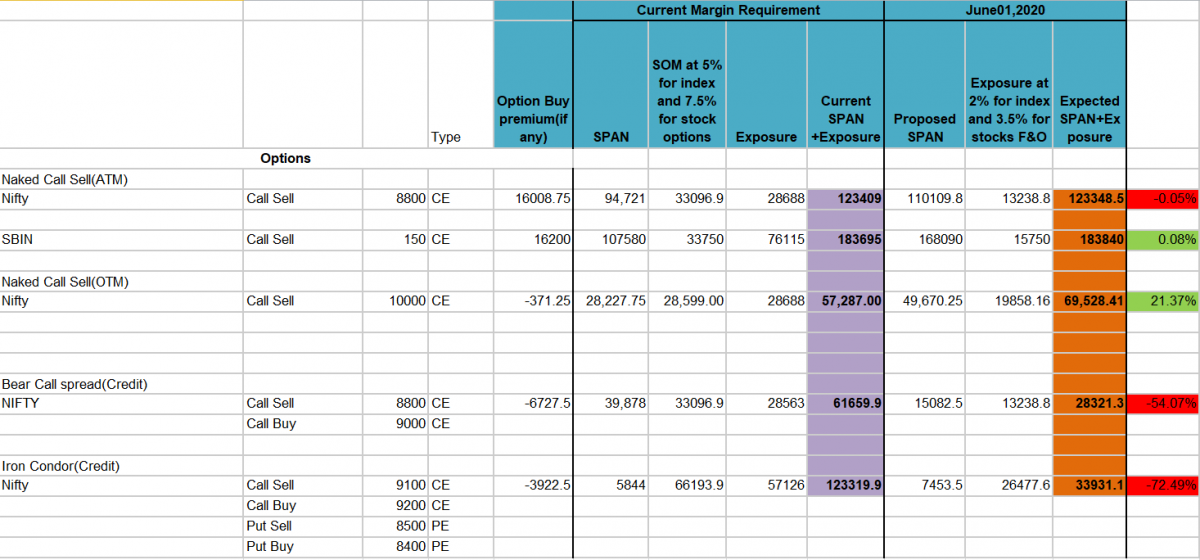

New Hedging Margin In Options(Index&Stocks)

In above image we can see the margin reduction in comparison to naked options positions.

For a bear call spread strategy in option with new margin framework you can take position with just Rs.28,321.

Iron condor strategies are likely going to benefit highly as whopping 70% reduction in them.

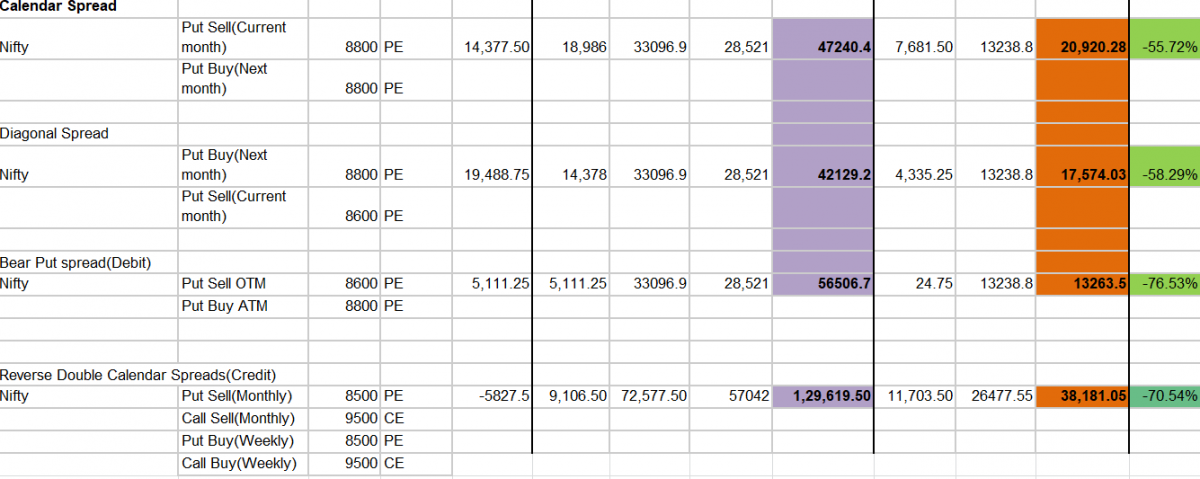

Let us see some calendar spread strategies and impact of new margin from June 01,2020

Above information may change in real time scenario, this is just an estimate for now, would request you to wait till June 01 2020 to get more clarity.

You can also read PPT on the new margin implementation webinar that is happened on 22 may, 2020 here for more guidance.

Now, that you know about the margin reduction, let me tell you about how you can take position in Rupeezy wave and Odin.

How To Place Multi Leg Order In Rupeezy Wave

You can download the Rupeezy wave application from here.

Open application go to watch-list, if the index or stock is already added , just click on that and it will give you the option to place multi-leg orders,

click on that it will take you to place orders in 3 different legs.

All the position are carry forward in nature, however you can square off your position within same trading day, if you do not want to carryover the position.

IOC refers to order type as immediate or cancel, all the orders will be placed at market price only.

You can place the order at once and the margin will be reduced or adjusted for the position spontaneously.

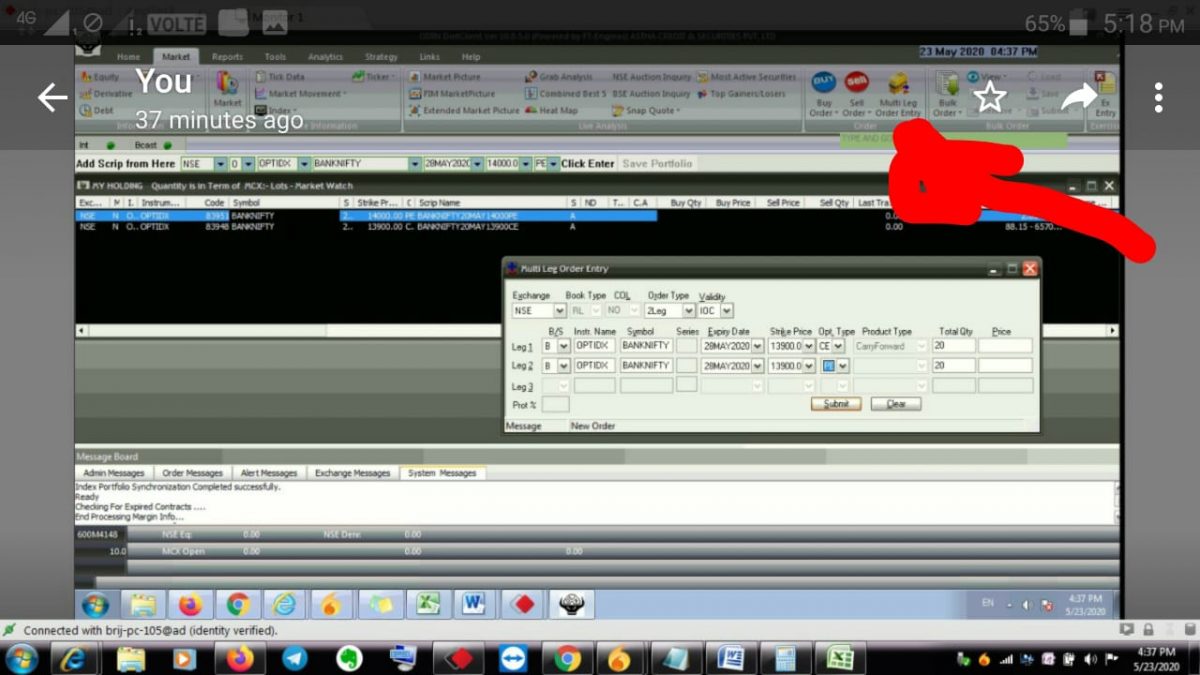

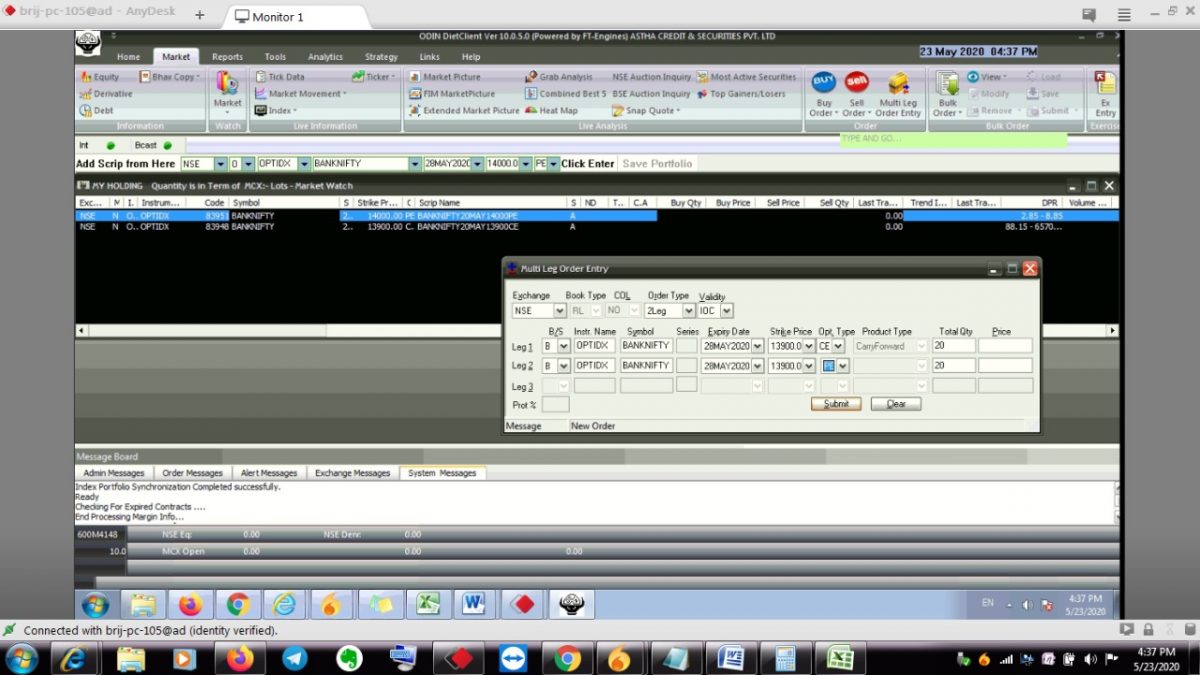

How To Place Multi Leg Order In Asthatrade Odin

Similar to wave to place the order in odin, click on multi-leg order entry at the top, Next windows shows you the 3legs to place the order at once.

If you any question related to multi-leg orders or application please contact our support team by email at support@rupeezy.in, you can also submit the ticket here.

We will keep you posted if any new updation comes related to hedging margin framework.