In what may call a Good News for all the traders in FNO segment, margin requirement have been reduced for hedged position.

SEBI review of margin framework on monday meeting with Sebi’s Risk Management Review Committee came up with possible solution.

This new framework will help traders with position build for mutually hedged options contracts.

This primarily will help margin reduction for positions that hedge each other. You can check the SEBI new circular here. There is no change in margin requirement for cash market segment.

Update

The changes in the margin framework will be effective from June 1st, 2020.

Check this NSE circular, SEBI Circular

Checkout our new blog on impact of new hedging margin in Future and option here.

Margin framework for Cash Market:

Earlier there was no fixed VAR + ELM structure for Group 2 and 3 stocks however it is been steup to be minimum 21.5%

VAR and 3.5% exposure margin for group 2 and minimum 50% VAR and 3.5% exposure margin for Group 3.

Margin framework for Derivatives (Index Derivatives, Single Stock Derivatives)

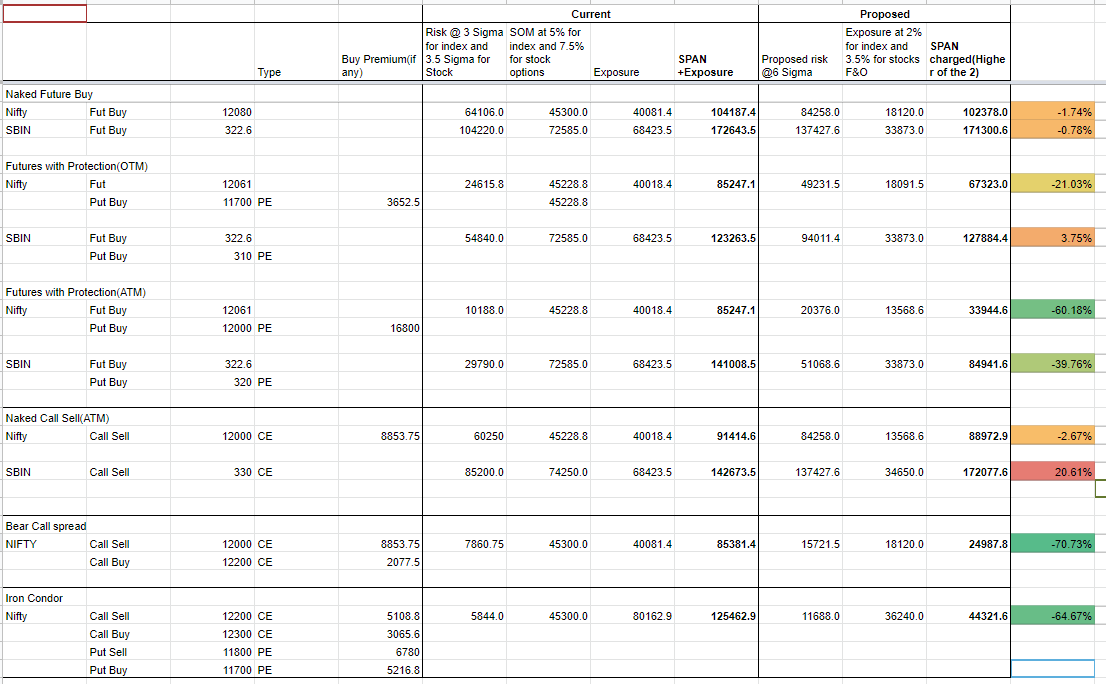

The reduction in margin requirement for various option strategies estimates to go down by 60-70%. However margin required is rather the same for naked F&O positions.

Whereas margin requirement reduced for positions which have limited risk going to reduce by almost 70%.

This will be appliacable most likely from May 1st 2020.

So, if a client takes two mutually offsetting positions, this will allow them to reduce the total margin payment required to take the position in market.

To understand it better please look at the below image

As you can Price scan range is now 6 Sigma compare to 3.5 Sigma, This means is that if volatility picks up, margin increase will be little higher than before.

You can check the margin requirement for option strategies like IRON condor, BEAR call spread and some other who has limited risk potential been reduced to more than 60%.

This will also lead to increase in the liquidity in stock option.

Where as strategies like Short straddle or Strangle who don’t have a defined maximum loss, the margins will remain more or less the same.

Some other points releated to circular

In its circular SEBI said, the value of the marginal risk rate is divided into three categories based on liquidity.

Regarding the margin framework for derivatives, the regulator reviewed its guidelines regarding volatility calculations,

Price and volatility scan ranges, calendar spread fees, minimum short option fees, extreme loss margins, and combined crystal obligation margins.

Another requirement is to provide additional margin for highly volatile stocks.

“For securities in which the bid price in the bidding market in the past month has exceeded 10% for three consecutive days or longer.

The minimum total margin should equal the maximum daily price movement of the securities observed in the securities market. Underlying market, ” SEBI Said that.

It added that this would continue until the monthly expiry date of the derivative contract was completed three months from the date of levy.

For securities that have won bids in the market over the past six months with intra-day price changes of more than 10% or more than 10 days,

The minimum total margin will equal the maximum intra-day price change of the security in the past six months, the regulator said.

Conclusion

In forth coming days we will be able to provide more details on types of strategies that will be benefited most from this.

As this circular will be implement from 1st may 2020, SEBI will definitely be coming up with more clarifications.

Incase you have any questions or feedback please let us know in comment box below.