How to Predict and Calculate the Next Candlestick

Summary: Here’s our complete guide to candlesticks and how they are used to predict bull and bear markets.

We’ve decoded a range of bullish and bearish patterns to detect market movements.

Candlesticks were first used in Japan 100 years ago for the supply and demand of rice. Surprising, right?

Later, they were introduced to the stock market to represent the price movements using various colors.

Did you know that market sentiments can be detected by reading candlestick patterns? But how do you do it? Let’s learn about candlesticks in this article.

What Are Candlestick Charts?

A candlestick is a price chart representing data from many timeframes in a single price bar.

The patterns generated by these candlestick patterns, over time, can aid traders in identifying crucial support and resistance levels as well as making educated forecasts regarding future price movements.

In this article, we’ll talk about bull market and bear market predictions using candlestick patterns.

Bull Market Prediction

Bullish candlestick patterns may indicate a trend change from down to up.

Traders use them to make educated judgments about initiating a long position in general. Here are some examples of candlestick patterns:

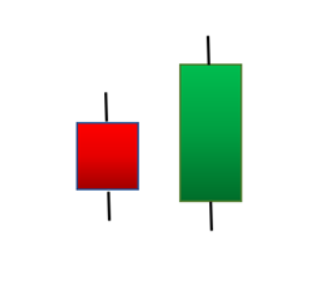

Bullish Engulfing Pattern

A bullish engulfing pattern is formed when there are more buyers in the market than the number of sellers.

The bigger, green candlestick engulfs (covers) the smaller red candlestick in this pattern.

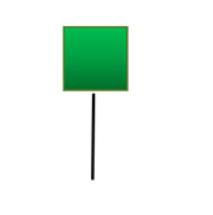

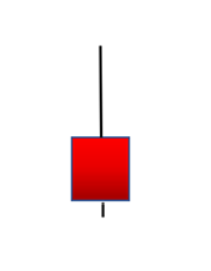

Hammer Candlestick

A hammer candlestick consists of a small body on the top and a long wick at the bottom of the candlestick.

A hammer is formed at the end of the downtrend. This candlestick indicates that the sellers have had selling pressure, but buyers won the game by pushing the price upwards.

After the formation of the hammer, the next candlestick could be a green candle.

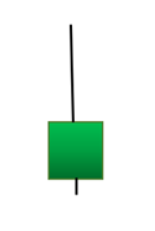

Inverted Hammer

This candlestick pattern is identical to the last one, except the upper wick is longer.

It’s assumed that sellers attempted to seize control even though there was purchasing pressure, but they were unsuccessful in driving the price down.

As a result, buyers are expected to reclaim market control soon.

Bear Market Prediction

In contrast to the bullish candlesticks, bearish candlestick patterns indicate a reversal from an uptrend toward the downside.

They are commonly used to detect resistance levels and as a signal to begin a short position. Here are some examples of these patterns:

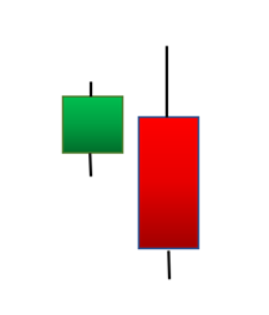

Bearish Engulfing Pattern

This pattern is formed when a short, green candle is followed and consumed by a lengthy red body candle near the end of an upward trend.

It suggests a halt in price movement and a possible market decline. The lower the engulfing candle, the more likely a negative trend is on the horizon.

Shooting Star

This pattern, which looks like an inverted hammer, is frequently generated in a bearish market. It has a tiny body and a long top wick.

The pattern appears when the close price is only slightly lower than the open price, despite the price rallying during the session. It nearly appears to be a shooting star plummeting to Earth.

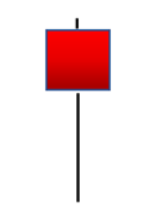

Hanging Man

This is a bearish market hammer. It comes after an upswing and marks the beginning of a decline.

The below diagram shows that the buyers gave a tough fight to push the market upward.

But at the end of that candle time frame, the sellers managed to defeat the buyers the made the candle close in the red.

So, now you know how candlestick patterns can decide market movement.

Probably sounds like magic, but it isn’t. It’s all about being observant and keeping a close watch on the market.

Candlesticks make a trader’s life so much easier – one can detect the market sentiment just by looking at these patterns.

Earning money was never easy, but with these indicators, you can get closer to your goals!

thank you so much for this much needed information